Strong Pores and skin Care Enterprise Aids The Estee Lauder Corporations (EL)

Strong Pores and skin Care gross sales and energy in e-commerce enterprise is favoring The Estee Lauder Corporations Inc. EL. The main skincare, make-up, perfume and hair care product supplier’s presence in rising markets is noteworthy.

Let’s delve deeper.

Pores and skin Care Division: Key Driver

The corporate’s Pores and skin Care portfolio has been performing properly. Throughout the third quarter of fiscal 2022, the Pores and skin Care class’s gross sales have been up 6% yr over yr (up 7% at fixed forex or cc) to $2,395 million. Throughout the quarter, Pores and skin Care web gross sales rose in The Americas and EMEA areas, fueled by stable double-digit La Mer gross sales progress. In Could 2021, The Estee Lauder Corporations took a step to broaden its Pores and skin Care enterprise when it concluded the primary section of elevating its possession stake in DECIEM Magnificence Group Inc. (DECIEM). The corporate has practically 76% possession in DECIEM in contrast with 29% earlier. The addition of DECIEM complimented the corporate’s reported gross sales progress within the fiscal third quarter.

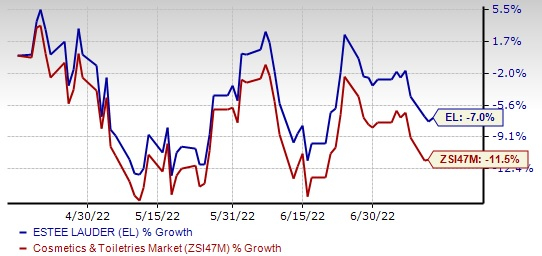

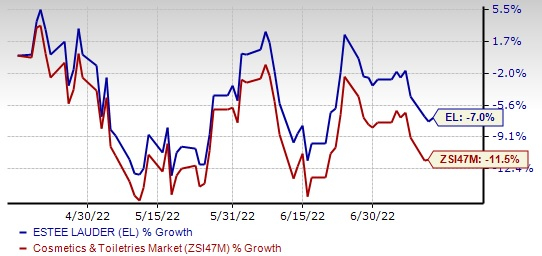

Picture Supply: Zacks Funding Analysis

On-line Operations & Rising Market Presence

The Zacks Rank #3 (Maintain) firm has a robust on-line enterprise and expects it to be a serious progress engine. The corporate has been implementing new know-how and digital experiences, together with on-line reserving for every retailer appointment, omni-channel loyalty applications and high-touch cellular providers. These initiatives and the corporate’s digital-first mindset have been aiding the corporate’s on-line gross sales. Administration is targeted on correct product placement and shows case instruments, together with digital try-on, to ease decision-making. The corporate’s on-line enterprise remained stable, pushed by progress in areas the place pandemic-induced restrictions have been in place. The corporate has been increasing its omnichannel capabilities to make shoppers’ procuring choices versatile and handy.

The Estee Lauder Corporations has a robust presence in rising markets, insulating it from the macroeconomic headwinds within the matured markets. The corporate derives vital revenues from rising markets like Thailand, India, Russia and Brazil, encouraging it to make distributional, digital and advertising and marketing investments in these nations. The Estee Lauder Corporations is investing in catering to shopper demand in China and Asia. To this finish, it purchased Korea-based skincare model Dr. Jart in 2019.

Wrapping Up

Throughout the third quarter of fiscal 2022, The Estee Lauder Corporations’ natural gross sales fell in mid-single-digits throughout Mainland China, as a heavy decline in brick-and-mortar gross sales offset on-line progress. The corporate witnessed elevated pandemic-inflicted restrictions throughout China from March 2022. Such short-term restrictions brought about softness in shopper visitors and journey. In its final earnings name, administration famous that the continued restrictions in China are short-term, nevertheless it expects these headwinds to have a better influence on fourth-quarter outcomes relative to the third quarter.

That being mentioned, The Estee Lauder Corporations’ aforementioned upsides are more likely to supply respite.

Shares of EL have dropped 7% previously three months in contrast with the trade’s 11.5% decline.

Searching for High-Ranked Staple Bets? Verify These

Some better-ranked shares are Sysco Company SYY, Medifast MED and Campbell Soup CPB.

Sysco, which engages in advertising and marketing and distributing varied meals and associated merchandise, sports activities a Zacks Rank #1 (Sturdy Purchase). SYY has a trailing four-quarter earnings shock of 9.1%, on common. You possibly can see the entire record of right now’s Zacks #1 Rank shares right here.

The Zacks Consensus Estimate for Sysco’s present monetary yr gross sales and earnings per share (EPS) suggests progress of 32.5% and 124.3%, respectively, from the year-ago reported quantity

Medifast, which manufactures and distributes weight reduction, weight administration, wholesome dwelling merchandise and different consumable well being and dietary merchandise, presently carries a Zacks Rank #2 (Purchase). MED has a trailing four-quarter earnings shock of 12.9%, on common.

The Zacks Consensus Estimate for Medifast’s present monetary yr gross sales and EPS suggests progress of virtually 19% and 13.4%, respectively, from the year-ago reported determine.

Campbell Soup, which manufactures and markets meals and beverage merchandise, presently carries a Zacks Rank #2. Campbell Soup has a trailing four-quarter earnings shock of 10.8%, on common.

The Zacks Consensus Estimate for CPB’s present monetary yr gross sales suggests progress of 0.5% from the year-ago reported determine.

Zacks Names “Single Greatest Decide to Double”

From hundreds of shares, 5 Zacks specialists every have chosen their favourite to skyrocket +100% or extra in months to return. From these 5, Director of Analysis Sheraz Mian hand-picks one to have essentially the most explosive upside of all.

It’s a little-known chemical firm that’s up 65% over final yr, but nonetheless grime low-cost. With unrelenting demand, hovering 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail traders may leap in at any time.

This firm may rival or surpass different latest Zacks’ Shares Set to Double like Boston Beer Firm which shot up +143.0% in little greater than 9 months and NVIDIA which boomed +175.9% in a single yr.

Free: See Our High Inventory and 4 Runners Up >>

Click on to get this free report

The Estee Lauder Corporations Inc. (EL): Free Inventory Evaluation Report

Campbell Soup Firm (CPB): Free Inventory Evaluation Report

Sysco Company (SYY): Free Inventory Evaluation Report

MEDIFAST INC (MED): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.